TaxJar provides automated sales tax reports and filing for online merchants in the United States. To generate state-based reports and determine how much sales tax a merchant has collected vs. how much they ought to have collected, we need their order and refund transactions.

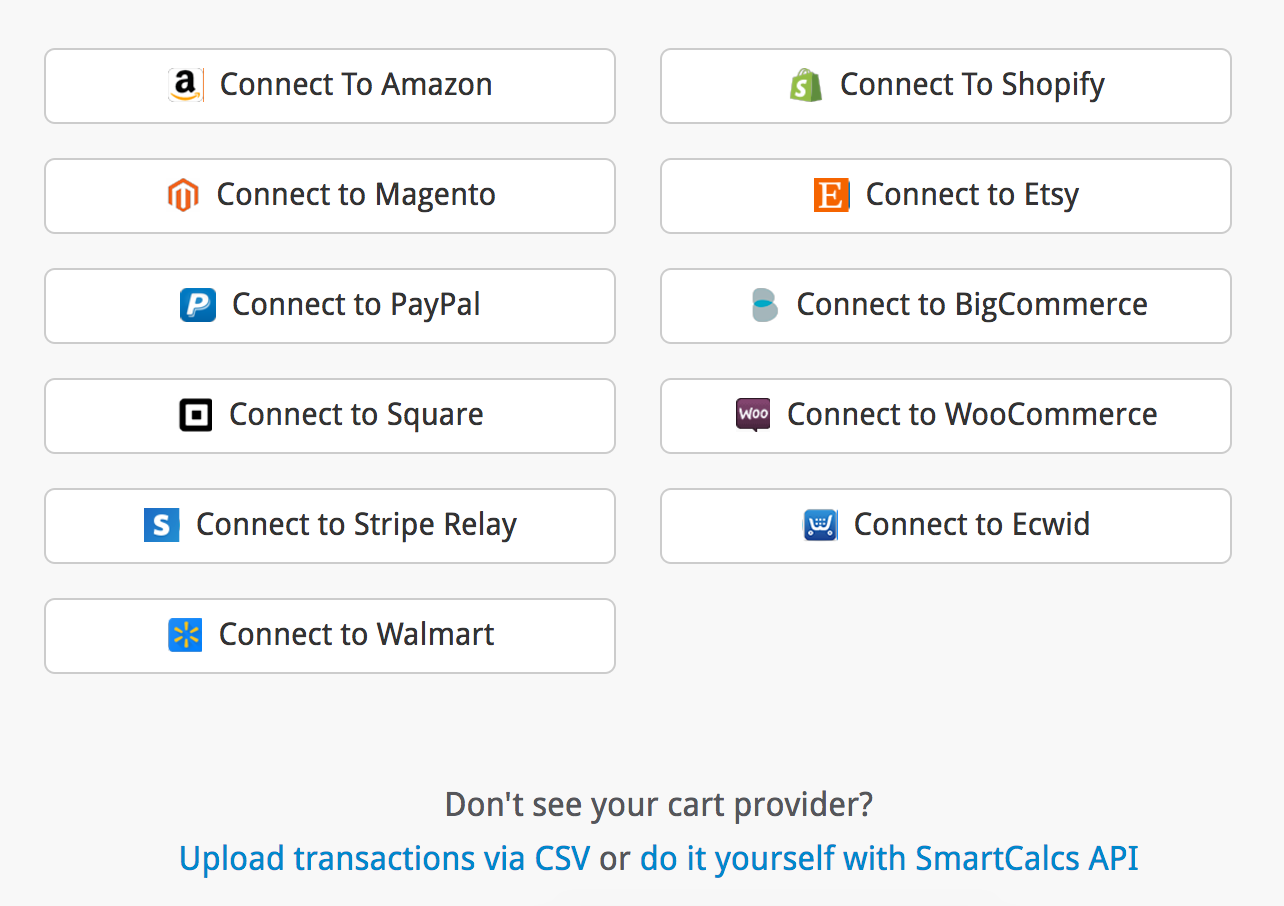

Transactions are imported into TaxJar either one of two ways:

-

From the TaxJar app using an in-house integration, such as Amazon, eBay, or Walmart. TaxJar queues up workers behind-the-scenes to go out and import transactions from a merchant’s store on a nightly basis. Merchants can backfill transactions from previous dates.

Note: Only in-house integrations are shown in the TaxJar welcome dialog. Custom integrations can be found on our sales tax integrations page. We hope to provide more opportunities for exposure inside the TaxJar app soon. Contact us for more information.

Note: Only in-house integrations are shown in the TaxJar welcome dialog. Custom integrations can be found on our sales tax integrations page. We hope to provide more opportunities for exposure inside the TaxJar app soon. Contact us for more information. -

In real-time through the TaxJar API using the API transaction endpoints. When to import a merchant’s transactions and supporting backfills is provided at the discretion of the platform.

If you’re building a custom integration with TaxJar, you’ll want to use our API to import transactions into TaxJar. The biggest advantage of this method involves real-time importing — the moment a transaction is paid and shipped, you can import it into TaxJar. It’s also the fastest way to get transactions into our system.

Order Transactions

While you can import orders at any time, we recommend importing an order once it’s been shipped and paid/invoiced. If an order is canceled, you can avoid having to delete the order from TaxJar if you wait until it’s been paid. There’s a couple ways you may want to do this:

-

If your platform has a

completed_atdate, only import orders that have been completed. -

If your platform has the notion of an order status, ensure the order status is in a shipped, paid, or complete status before importing.

It’s best to implement your transaction import for TaxJar when the order state changes or when an order is updated.

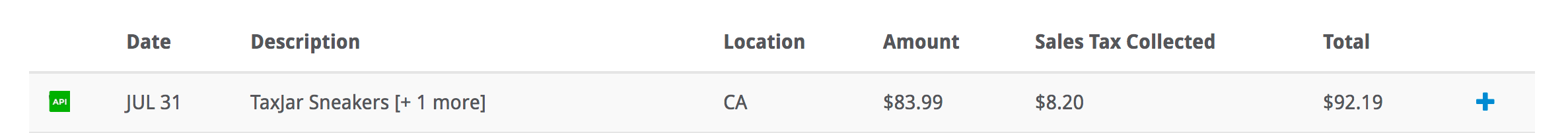

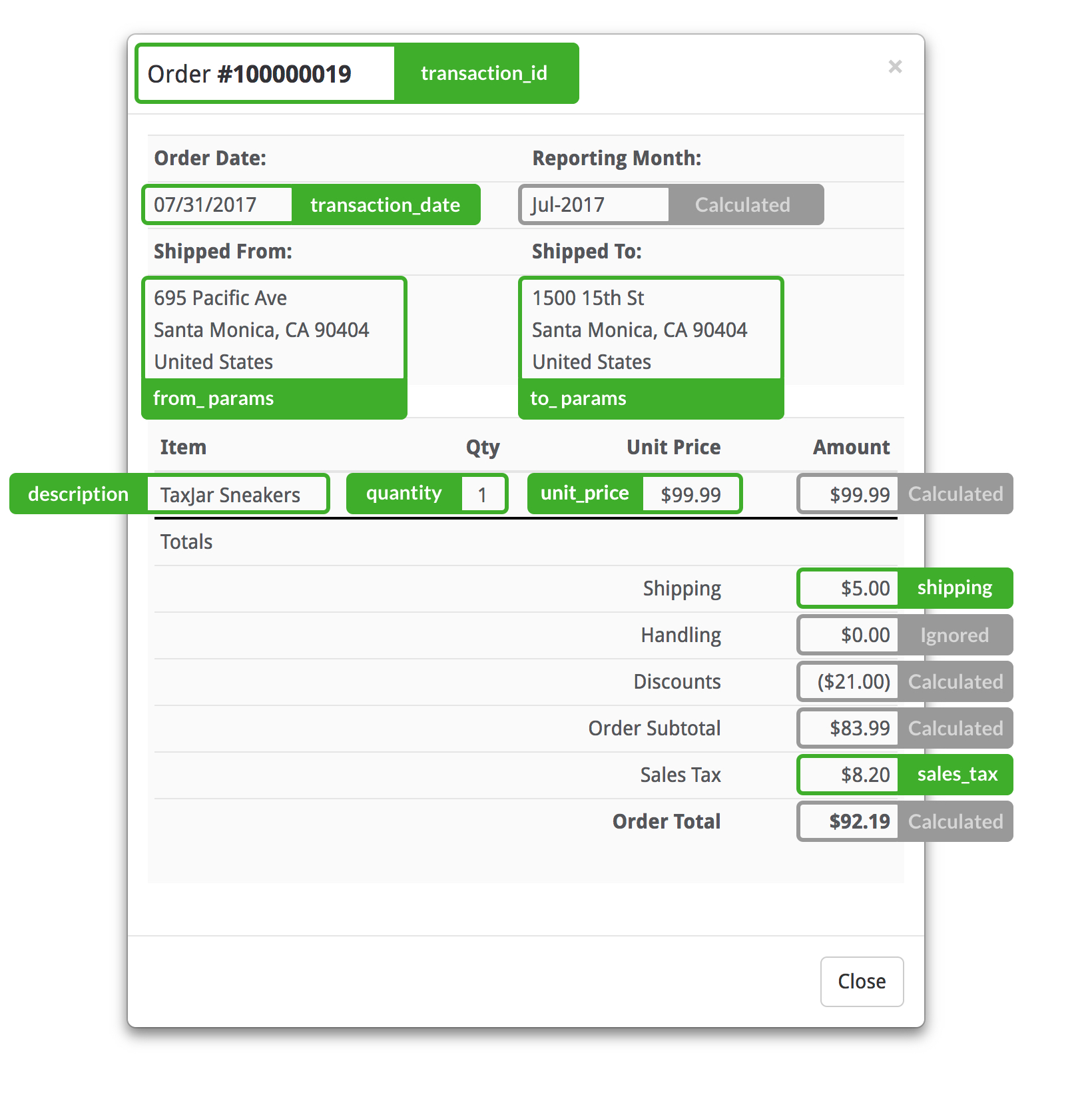

When you import an order into TaxJar, it will show up as an “API Transaction” in the merchant’s account under Transactions:

Import all US-based transactions, not just where the merchant has nexus. Your merchants may reach economic nexus thresholds based on their total revenue or number of transactions in a given state without a physical presence. Our sales and transactions checker helps them determine if they hit these thresholds and need to register in additional states.

Transaction ID & Date

When providing a transaction_id for an order transaction, use the unique increment identifier associated with the order. If it’s possible that this ID can overlap between multiple stores or different types of transactions for this merchant, you may want to prepend or append a unique string on the ID.

For example, we append “-refund” to refund transaction IDs in Magento since order and refund transaction IDs can overlap each other.

Next you’ll need to provide the transaction_date parameter. We recommend using an order created_at datetime for transaction_date since we want to record the exact date when the transaction took place and sales tax was collected.

json

{

"transaction_id": "0000000001",

"transaction_date": "2017/09/01"

}

Provider

The provider parameter provides a pivotal role in sending TaxJar order and refund transactions. By default, the provider parameter will always have a value of 'api' unless otherwise specified.

The purpose of a provider value serves two purposes:

-

Identify the source of the order or refund; and

-

Exempt the order or refund from sales tax, if it includes a supported value.

Identify the source of the order or refund

It is sometimes helpful to track the source of a sale for record purposes. TaxJar accounts have the ability to export transaction data and see the source via the provider parameter. For example, 'provider': 'pos' for on-site sales, or 'provider': 'conference_booth' for events.

Exempting Order or Refund Transactions by Provider

TaxJar supports identification via provider for the following values:

-

'amazon' -

'ebay' -

'etsy' -

'facebook' -

'walmart'

State laws vary in whether or not the merchant or marketplace platform are responsible for sales tax filing and remittance. TaxJar’s software logic handles marketplace facilitator law determination by state, in addition to the date the law has taken effect. For more information and a list of details by state and date, see State by State: Marketplace Facilitator Laws Explained.

If a software integration meets all of the following conditions, these transactions should be created in TaxJar along with the appropriate provider:

-

The merchant sells on one of the supported marketplace platforms listed above

-

The software supports importing transactions from any of the marketplace platforms above

-

The merchant is not connecting a marketplace platform directly to TaxJar, but wants the software to unify sending all transactions to TaxJar

Not taking advantage of the provider parameter could result in transaction duplication in TaxJar.

In the event of marketplace sales being made on a platform outside of the above, ensure your software passes an order-level exemption type with a value of 'marketplace'. If one of the supported provider values is provided, it is not necessary to specify an exemption_type.

From & To Address

-

Use the store’s location or shipping origin for the

from_parameters. -

Use the customer’s shipping address for the

to_parameters, unless it’s a digital / virtual product or in-store pickup (similar to calculations).

json

{

"from_street": "123 Pacific Ave",

"from_city": "Santa Monica",

"from_state": "CA",

"from_zip": "90002",

"from_country": "US",

"to_street": "123 Palm Grove Ln",

"to_city": "Los Angeles",

"to_state": "CA",

"to_zip": "90002",

"to_country": "US"

}

Amount, Shipping, and Sales Tax

One particular gotcha with this amount param — this time include the shipping, but do not include sales tax. This is confusing, we know, and we hope to provide more consistency in a future iteration of our API.

Also, use dollars for the amounts in these endpoints! Right now we only support USD currency in the TaxJar app.

The shipping and sales_tax params are required. Provide the total order amounts for each.

json

{

"amount": 16.5,

"shipping": 1.5,

"sales_tax": 0.95

}

Line Items

Since transactions are shown directly in the TaxJar app for merchants to review, we always recommend including line items. Here’s how we show the transaction data you provide in TaxJar:

The first line item you send in an API request will always be used for the transaction’s title in TaxJar. If multiple line items are included, the merchant will see a “[+ X more]” appended to the title.

In addition to order-level sales_tax, include the amount of sales tax that applies to each line item by passing the line item sales_tax param. If this is not technically feasible, we recommend proportionally distributing the tax across taxable line items.

json

{

"amount": 20,

"shipping": 5,

"sales_tax": 1.35,

"line_items": [

{

"id": "1",

"quantity": 1,

"unit_price": 10,

"sales_tax": 0.90

},

{

"id": "2",

"quantity": 1,

"unit_price": 5,

"sales_tax": 0.45

}

]

}

Remember, discounts are provided at the line item level factoring in the quantity, not per unit.

Discount: $1.00 each

json

{

"line_items": [

{

"quantity": 3,

"product_identifier": "12-34234-9",

"description": "Fuzzy Widget",

"unit_price": 5,

"discount": 3,

"sales_tax": 0.95

}

]

}

Similar to sales tax calculations, remember to distribute order-level discounts across line items proportionally or evenly.

Discount: 50%

json

{

"line_items": [

{

"id": "1",

"quantity": 2,

"unit_price": 5,

"discount": 5,

"sales_tax": 0.45

},

{

"id": "2",

"quantity": 1,

"unit_price": 10,

"discount": 5,

"sales_tax": 0.45

}

]

}

Note: If an order is paid for with a gift card or store credit, the amount should not be included in discount. Gift cards are tax-exempt when purchased, but do not reduce tax when applied to an order.

Customer Exemptions

When exempting orders from sales tax for a given customer, your merchants will expect TaxJar to recognize the order as exempt for reporting and filing as well. To support customer exemptions, use our customer endpoints to sync a merchant’s customers when they’re created or updated. After creating a customer in TaxJar with a designated exemption type such as wholesale or government, you can pass a customer_id to our tax calculation and transaction endpoints. This allows us to determine whether or not the customer should be exempt from sales tax.

json

{

"customer_id": "123"

}

If your merchant already has exempt customers, you’ll need to backfill these customers using our API to make sure they’re in our system prior to calculating sales tax or pushing a transaction with the customer_id.

Order-level Exemptions

Transactions may also be marked as tax-exempt at the order-level by passing the exemption_type param in calculations as well as when creating or updating transactions. Allowable values are government, wholesale, other, and non_exempt.

One use case is to mark a single transaction as taxable for an otherwise exempt customer by passing non_exempt. With the exception of non_exempt, a customer exemption type takes precedence over an order-level exemption type. In other words, when usage of the customer_id param qualifies the transaction as exempt, the customer’s exemption type will be applied, rather than the value of exemption_type sent in the request.

Shipping Discounts

The API doesn’t provide an order-level discount param for shipping. To handle a shipping discount, simply deduct the amount from the shipping param. Given a free shipping discount, set shipping to zero.

json

{

"shipping": 0

}

Handling Fees

Since we currently do not support a handling param, you’ll need to add any handling fees as a separate line item. Feel free to use the description param inside line_items[] to label as a handling fee:

json

{

"line_items": [

{

"description": "Handling Fee",

"unit_price": 3.5

}

]

}

Refund Transactions

TaxJar supports both full and partial refund transactions. Additionally, you can import multiple refund transactions for a single order via transaction_reference_id.

Transaction ID, Reference ID, and Date

Similar to orders, always provide a unique transaction_id. If it’s possible that a refund ID can overlap with an order ID, append “-refund” to the end of the refund transaction_id.

Submit the refund’s order ID for transaction_reference_id .

The refund transaction_date should be the date the refund is created.

json

{

"transaction_id": "0000000001-refund",

"transaction_date": "2017/09/01"

}

Other Parameters

Remaining parameters for refund transactions should behave similarly to order transactions.

For partial refunds, include the reduced amount and line item amounts when making the API request.

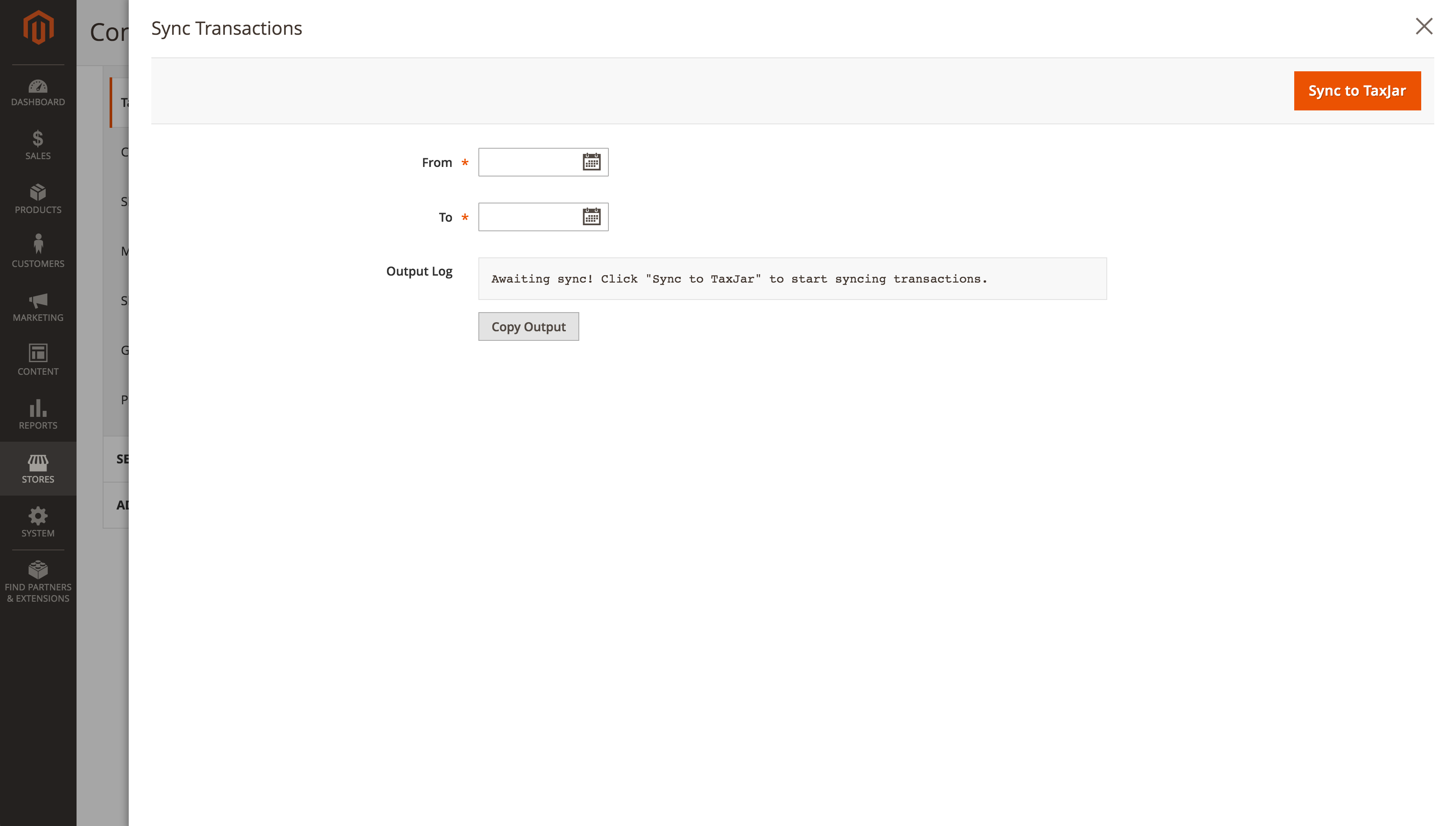

Backfilling Transactions

If you’re integrating TaxJar into an established platform, your merchants may want to “backfill” their previous transactions into TaxJar for reporting purposes. This isn’t absolutely required, but it will save your merchants time not having to do it themselves.

Alternatively, you can allow them export their old transactions to a CSV file and they can upload it manually through the TaxJar app.

To backfill transactions through the TaxJar API, you should filter a collection of order transactions by an updated_at or created_at date range and based on the API guidelines mentioned below. Using updated_at ensures you’ll catch older orders that may have taken longer to process, whereas created_at allows you to import orders created on a specific date or date range. Typically we use updated_at to find transactions.

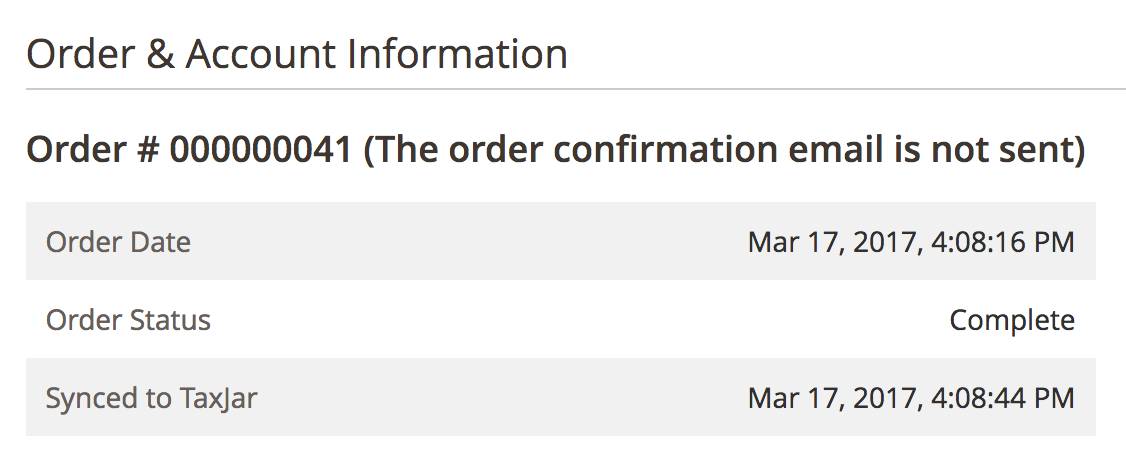

Our in-house Magento 2 integration is a good example to follow for backfilling transactions. For each transaction, we set a sync date for each order and credit memo (refund) in the merchant’s database:

- No sync date? Create the transaction in TaxJar (

POSTrequest). - Transaction hasn’t been updated since sync date? Skip the transaction.

- Transaction updated? Update the transaction in TaxJar (

PUTrequest).

If we encounter a 422 error when attempting to create a new transaction that exists, we fallback to an update (PUT) request.

If we encounter a 404 error when attempting to update an existing transaction that does not exist, we fallback to a create (POST) request.

Along the way, we check each transaction to ensure it adheres to the API guidelines. Only complete and closed transactions are imported from Magento 2. Each API request and response is logged for the merchant to review later if needed.

API Guidelines

-

Import order transactions after they’ve been shipped and paid/invoiced.

-

We recommend only importing US-based transactions for merchants. At this time, our reporting app only supports US sales tax reports.

-

Additionally, only import USD currency transactions.

Branding Guidelines

-

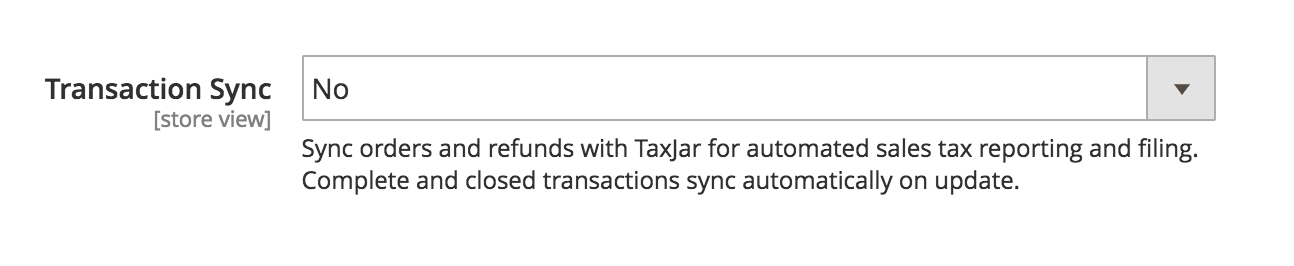

Use “Transaction Sync” when referring to real-time importing of order and refund transactions into TaxJar.

-

If you support importing older transactions within a date range, use the term “backfill” in headlines and action buttons such as “Backfill Transactions”.

Testing Guidelines

-

Use a separate TaxJar account for testing transactions.

-

Write integration tests between your platform and the TaxJar API integration to ensure your transaction import process properly handles order and refund transactions. Review a checklist of scenarios to test.

-

Consider using HTTP response fixtures instead of making an API request for each test. Mocking and stubbing libraries may assist with capturing TaxJar API responses for ongoing use. If a transaction already exists in TaxJar, you’ll receive an error if you attempt to re-create it using a

POSTrequest.

UX Guidelines

-

Use a separate checkbox or toggle switch to enable sales tax reporting. Transactions should only be imported into TaxJar if enabled:

-

Explain to your merchants how to backfill their previous orders into TaxJar, either through your own backfill functionality or via CSV upload.

-

In your help documentation, consider explaining when transactions appear in TaxJar and how they appear as an “API Transaction”.