- Stage

- Getting Started

- Audience

- All Sellers

- Last Updated

- June 14, 2016

Introduction

When to register for a sales tax license is an important question for eCommerce sellers.

There are the legal considerations such as whether or not you have “sales tax nexus” in a state (i.e. your business is required to collect and remit sales tax in that state.) There are also cost considerations regarding what it will cost in both time and cash to register, collect, and file.

Businesses shouldn’t register to collect sales tax in states where they don’t need to register, or register too early in any given state. Both of those mistakes could result in unnecessary costs and time spent on sales tax compliance.

Your business could be liable for paying sales tax regardless of whether or not you have collected it from your customers. One of the challenges for online sellers is that if you aren’t collecting sales tax in a state where you have sales tax nexus, the liability may actually hurt your own business’ cash flow. It’s nearly impossible to return to your hundreds or thousands of customers to collect that missed sales tax, and even if you could, it would be entirely too burdensome to undertake. So the longer you wait to begin collecting sales tax in a state where you have sales tax nexus, the more cost to your business for paying uncollected sales tax.

Once you are registered, sales tax management can be a manageable cost to the business. Tools like TaxJar make this process significantly easier.

Where does your business have sales tax nexus?

Nexus is created where you have more than the slightest physical presence, specifically, property, employees (the business owners), inventory and, in some instances, even the activities of independent third-parties (affiliates) acting on your behalf.

If you are an online seller with your own shopping cart (like Magento, Shopify or BigCommerce) and all your officers, employees, and inventory are in the same state, then you likely only have nexus in one state.

If you are an Amazon FBA seller, Amazon acts as a multi-state warehouse and distribution company. Amazon therefore creates nexus wherever they store your inventory (this is your property until it is accepted by the end customer), and this can generate sales tax collection and filing obligations in 15 (soon to be 16 or 17 before the holiday shopping season) Amazon warehouse states. Luckily, two of those states don’t collect sales tax (Delaware and New Hampshire). Still, this means that an Amazon FBA seller could be on the hook for sales tax in as many as 15 states by the end of 2014.

When did sales tax nexus start?

In the case of the primary state where the business is located, it is when the business made the first sale of a tangible product within the state where you are located.

DO NOT collect sales tax until you have a license in a state. Many states consider it unlawful to collect sales tax without a permit.

If you are an Amazon FBA seller, when did Amazon first move and store one of your products into a warehouse in a state? That is the moment that nexus was created. This information is buried in a ton of data on the Amazon Seller Central site. You can look up where your inventory is stored in Amazon by following these steps or by using a 3rd party tool such as wherestock.com.

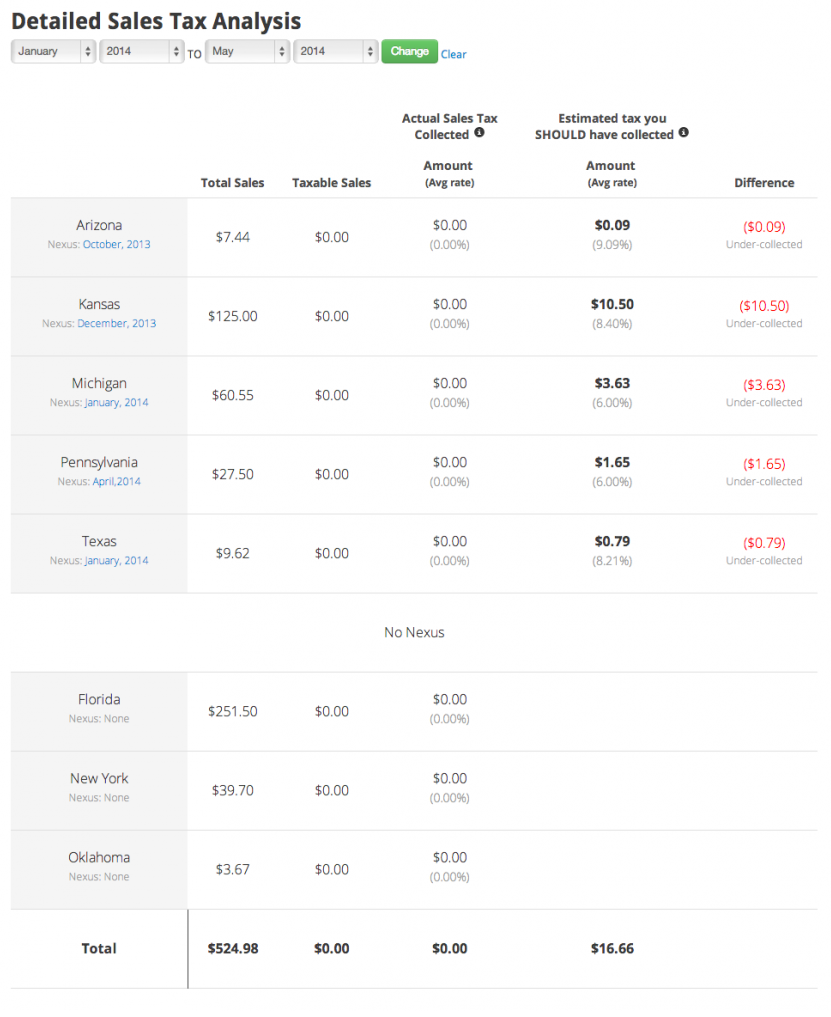

How much do I owe to each state?

How can you know how much you owe to each state? TaxJar provides a Detailed Sales Tax Analysis Report that will show the amount you haven’t collected. First you need to enter ALL of your sales data into TaxJar, including any channels you have connected (Shopify, Amazon, etc.). Next, ask the TaxJar Support to import data back to the beginning of your business (i.e. first Amazon/Shopify, etc. sale). Note: TaxJar by default only imports to the beginning of the current year. After this, you should import any sales that were handled outside of the channels TaxJar supports.

Next, select all the states where you have sales tax nexus, including the Amazon FBA button that TaxJar provides. The next step is to update the Nexus Established Date for every state. This is key, as you don’t want or need to collect sales tax before the date that sales tax nexus was established.

Now the Detailed Sales Tax Analysis should be accurate and you have the quantifiable information you need to decide where you should register for a sales tax permit.

What You Need to Know about “Materiality”

If you owe $5 in sales tax in a state, but the time and cost to you to file is going to exceed $5, then it might not be worth the trouble of filing. In addition to the hard costs, don’t forget to add in the time and effort by the owner. Yes, you may technically have a legal responsibility to file in that state, but you may want to evaluate the related risk and costs of not filing. It simply may not be worth the effort.

It is not a good business practice to register in all states and start filing from day one, it is one approach but by filing you create nexus (or at least tell the state that you have it) and this means you MUST now comply. It is better to wait until they have a “material” amount of sales tax. If not then you might spend your time and money filing many $0 returns.

Disclaimer

The information below outlines common approaches to common issues, but we do not recommend any action other than completely complying with legal regulations. The following should in no way constitute legal advice (we are not attorneys), and we are in no way recommending that your business game the system or not provide 100% accurate information when you are registering your business. We recommend that you talk to a lawyer and/or CPA familiar with your particular business circumstances and needs as well as the state and local tax regulations affecting your business.

This is a risk management decision for you as the business owner. The decision will be based on your attitude around compliance. If you are “by the book” type, then register everywhere with the date nexus was established and pay all the outstanding sales tax, interest and penalties. Legally this is how the laws are written and how the states interpret them. Sales Tax compliance is similar to breaking the speed limit, everyone breaks the speed limit and you are responsible for the consequences if you are caught (i.e. a speeding ticket or audit). If you are concerned about the cost, weren’t aware of your liability until recently, or think the chance of being audited are low, then you can choose not to register, collect, file and remit sales taxes in one or all states where you have nexus

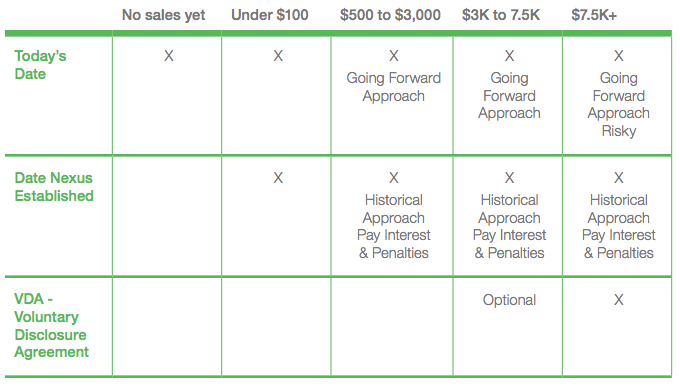

What date should you enter on the sales tax registration form?

This is a risk management decision that the business owner has to make. Based on how you approach business and compliance costs as well as the impact on your cash flow.

Note: Interest & Penalties are usually 50% of the amount owed. ~25% for penalties and 25% for interest (varies by state and situation).

Option 1 – No sales in that state yet

- Use the current date or the date you expect to have nexus

- Register 30 to 45 days before your first sale to limit the number of $0 returns.

Option 2a – A few sales, less than $100 sales tax owed

- Going Forward Approach - Use date nexus created, start collecting sales tax, file and remit sales taxes.

- Your challenge: the forms say that you have to list the first date you started doing business in the state, so you have to know this. If it was 12 months ago, the state might require that you file 12 monthly $0 sales tax returns (seriously) to be compliant. They may alsopossibly require you to pay penalties and interest.

Option 2b – A few sales, less than $100 sales tax owed

- Going Forward Approach - Use today’s date, start collecting sales tax, file, remit sales tax

- When you file the first return, add any sales tax you didn’t collect from your customers out of your money and pay it in. So in this case, you have paid any sales tax you should have submitted.

Option 3 – Same as two but you owe $500 to $3,000 to a state

- Historical Approach - Go with option 2a or 2b or provide the first date nexus was created. Plan to complete extra forms, file returns and pay some penalties and interest.

- Going Forward Approach - Use today’s date, accept the risk if audited, and start collecting going forward.

Option 4 – You owe more than $3,000 to $7,500 in sales tax

- Historical Approach - first date doing business, file properly, pay tax, penalties, and interest.

- Going Forward Approach - Use today’s date, hope you never get audited, and start collecting going forward.

Option 5 – Owe $7.5K, $10K, $50K, $100K+ to that state in uncollected sales tax

*VDA (Voluntary Disclosure Agreement) – a SALT company represents you anonymously, negotiates with the state, tries to get penalties and interest (only some states will waive interest) waived, completes historical filings and paperwork, hopefully negotiates a payment plan to pay uncollected sales tax. You should expect to pay all the sales tax owed as soon as the VDA is completed.

Note: you want to consider a VDA when it would save more than the penalties, interest, and filings costs. VDA’s are typically $1,500 to $2,500 for a straightforward one, complex ones where your business has been doing business in a state for years without filing could cost more.

Sales Tax Registration Date Decision Matrix

How to register?

Now that you have decided to register and what date to use, you need to register.

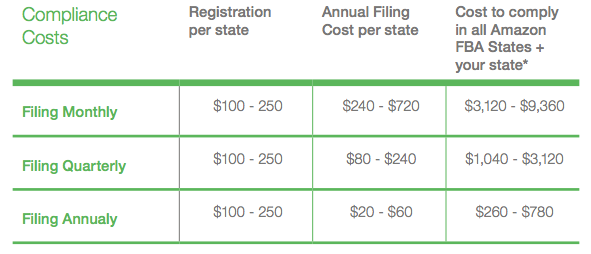

Your options for registering for a sales tax permit

- Register yourself (every state is different) - follow this link to find out how to register for a sales tax permit in many states

- Pay a registration company ($100 to $250/state)

- Outsource the whole sales tax management process

How to file?

How to file now that you have a sales tax license:

- File yourself, login to the state site or complete the forms using exported spreadsheets.

- File yourself using TaxJars return ready reports to eliminate spreadsheets and manual calculations

- Use the TaxJar to automatically file for you

- Outsource the whole sales tax management process

Filing with an outsourced service will cost between $20 and $60 per filing.

Example - Most states mandate that new businesses file monthly for the first year.

These list the ranges and best/worst case. Your business could have a mix of monthly/quarterly/annual filing.

A few more helpful tips

- Is is better to over collect (a little) than to under collect. The states will happily accept more sales tax revenue but may penalize you if they find out you have underpaid.

- Don’t forget to file even if there were no sales in a state. If you file monthly, you need to file every month otherwise fines and penalties can apply.

- Don’t forget to configure your shopping cart and/or Amazon account as soon as you get a new sales tax license.

- Keep track of the sales tax you collect on your sales with TaxJar.

- If you file quarterly or annually, put that money in a separate checking/savings account, even if you file monthly so the sales tax isn’t part of your daily cash flow.

- Keep an electronic copy of all the sales tax licenses, filings and any notices.

- Do not ignore notices. Review them, call the states, and address the issue.

- Keep all of the logins to the state sales tax sites in a password vault like LastPass.

Conclusion

Keep in mind that it’s up to you to file sales tax returns and pay what you owe to the states. Until TaxJar, that was a cumbersome, lengtyly process. Sales tax is a complex process with 13K+ jurisdictions, different rules, processes, filing requirements, etc. in every state/locality. Make the best effort in complying by making business decisions, defining a process, and leveraging tools (or outsourcing) to manage your sales tax compliance. If you are audited, you can show an awareness and willingness to comply.

This information was prepared on behalf of TaxJar by Scott Scharf of Catching Clouds.

Congratulations, you now know more than most about sales tax.

For more about TaxJar, to ask us a question, or to find out how to use TaxJar’s sales tax automation for your online store, visit TaxJar.com.