- Platform

- Square

- Versions

- All

- App Store

- Square

- Last Updated

- June 14, 2016

This guide will take you step by step through how to integrate TaxJar into your Square account. You’ll learn how to configure Square to automate sales tax calculations as well as what you need to do when it comes time to file.

Sales tax is complex, with regulations changing constantly. For a primer on the basics of sales tax, including nexus, registration, filing, reporting, calculations and more, please visit Sales Tax Fundamentals. Also, be sure to take a look at our Resource Center, with articles, webinars and videos for beginners and experts alike.

How to Connect to Your Square Store

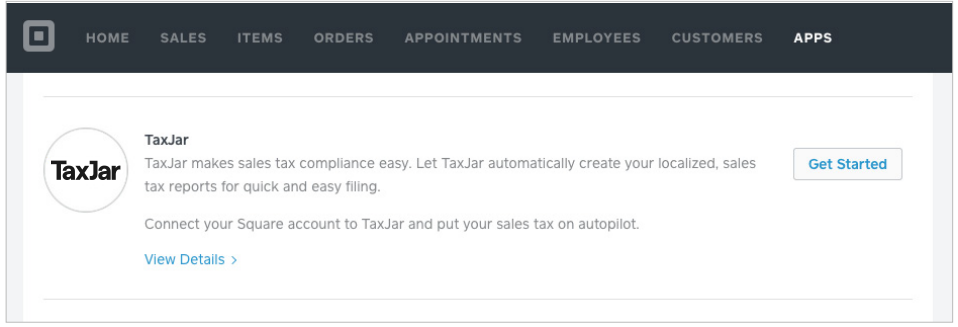

To install the TaxJar sales tax plugin from the Square App Store, start by logging into your Square dashboard.

- From your Square Dashboard, click the “Apps” tab.”

- Find TaxJar, then click “Get started”

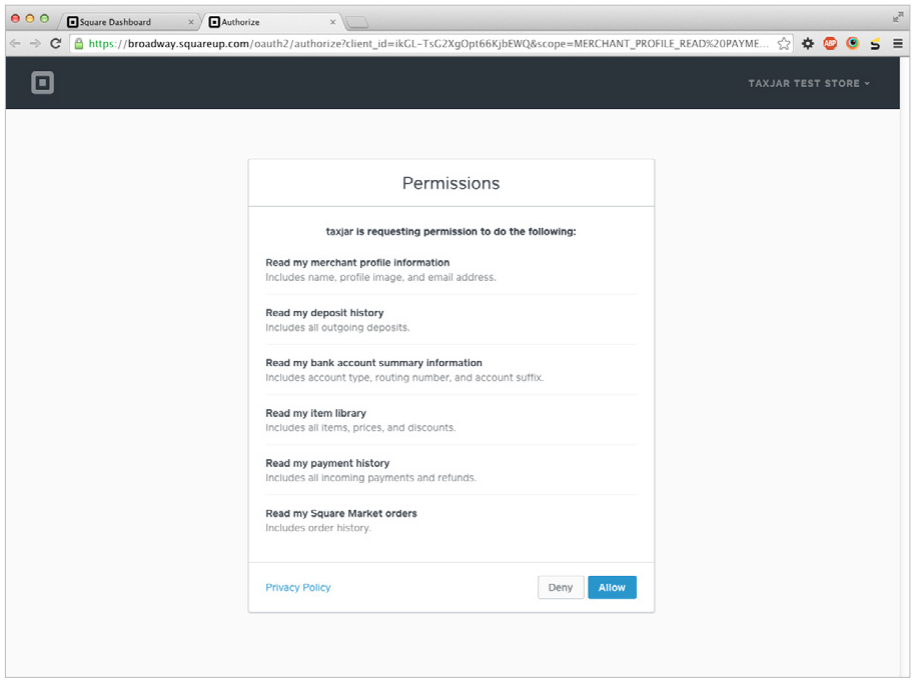

Read over the permission and click “Allow”

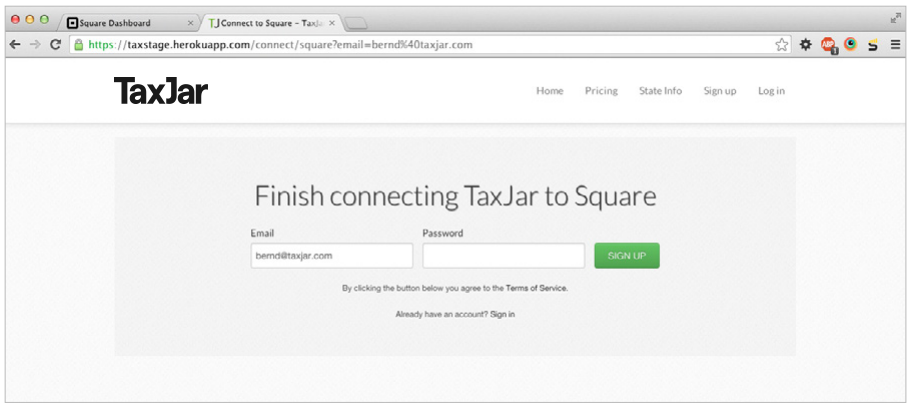

If you already have a TaxJar account, provide your username and password. If not, provide a password to sign up for a TaxJar account.

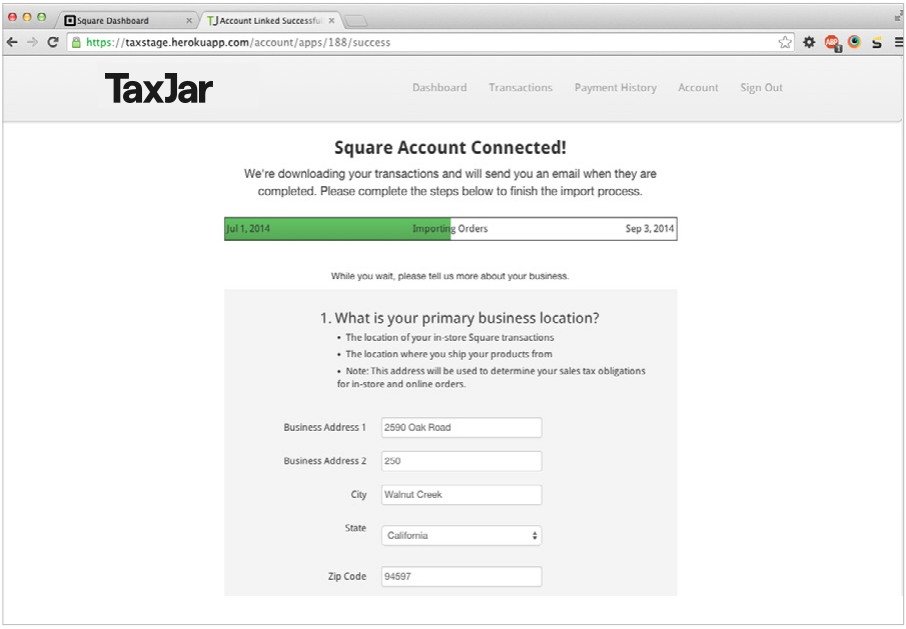

Once your Square and TaxJar accounts are connected, you’ll be asked to provide the address of your primary business location. We’ll use this address as your taxing jurisdiction by default.

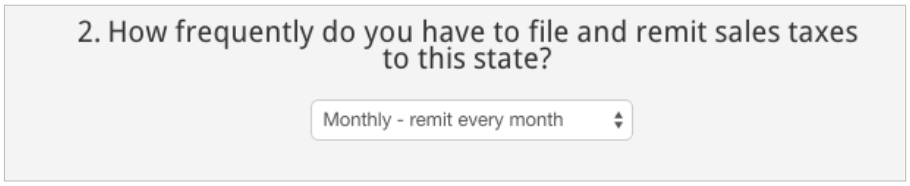

On this page, you’ll also be asked how often you remit sales tax to the state where your primary business address is located

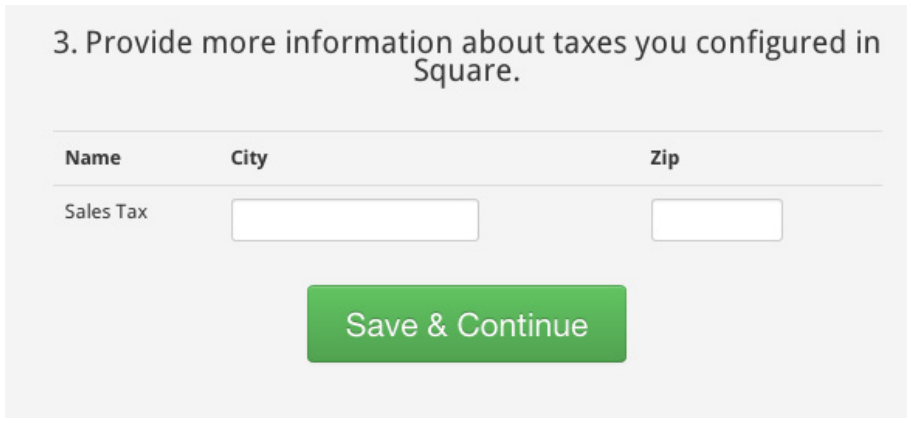

If you have already set up sales tax rates in your Square account to collect sales tax on transactions processed through Square, we’ll ask you to tell us where each of the sales tax rates are used so that TaxJar can identify which jurisdictions those transactions took place in

Congrats! Square and TaxJar are now working together in perfect harmony. TaxJar will now download your Square transactions every night.

Sales Tax Management for Square Merchants

Now for the nuts and bolts. How can you manage the hassle of sales tax with TaxJar?

Once you’ve connected your Square and TaxJar accounts, be on the lookout for an email from TaxJar. We’ll let you know which transactions imported and from which states.

Click on the state in that email to go to TaxJar and see more detailed information like:

- How much sales tax you collected

- Your gross sales for your sales tax filing period

- A breakdown of sales tax collected by county and district

From there you can use this information to fill out your own sales tax filing or click “AutoFile” and allow TaxJar to do it for you.

TaxJar also helps you troubleshoot sales tax compliance issues.

For example, your TaxJar dashboard shows you when no sales tax was collected. TaxJar’s “Detailed sales tax analysis report” will show you how much you SHOULD have collected vs. how much you did collect. You can use this information to determine whether you should pay that sales tax out of pocket to the state yourself.

If you have additional questions or need help integrating your Square and TaxJar accounts, please contact our support team.