- Platform

- Shopify

- Versions

- Shopify & Shopify Plus

- App Store

- Shopify

- Last Updated

- June 14, 2016

This guide will take you step by step through how to integrate TaxJar with your Shopify account. With your TaxJar integration, you’ll enable real-time sales tax calculations and reporting – along with the ability to automate your filing.

Sales tax is complex, with regulations changing constantly. For a primer on the basics of sales tax, including nexus, registration, filing, reporting, calculations and more, please visit Sales Tax Fundamentals. Also, be sure to take a look at our Resource Center, with articles, webinars and videos for beginners and experts alike.

How to Connect Your Shopify Store

Shopify’s built-in tax engine automatically collects sales tax for you, from wherever you tell it to - even if you have sales tax nexus in more than one state.

To turn on sales tax collection in Shopify, simply go to Settings > Taxes.

The Shopify Tax Manual quickly and thoroughly walks you through setting up sales tax.

Separate Sales Tax – Include your sales tax separately from the price of the item. Customers are accustomed to sales tax being added after the fact, and adding sales tax to the price of the item in your store may make your prices appear higher than a competitor’s

Local rates – Shopify allows you to charge taxes on shipping rates.Check Here to make sure that your state (or states) requires you to charge sales tax on shipping.

Be sure to set your tax overrides – For example, some categories, such as food and clothing, are tax exempt in certain states. Don’t collect sales tax when you don’t have to!

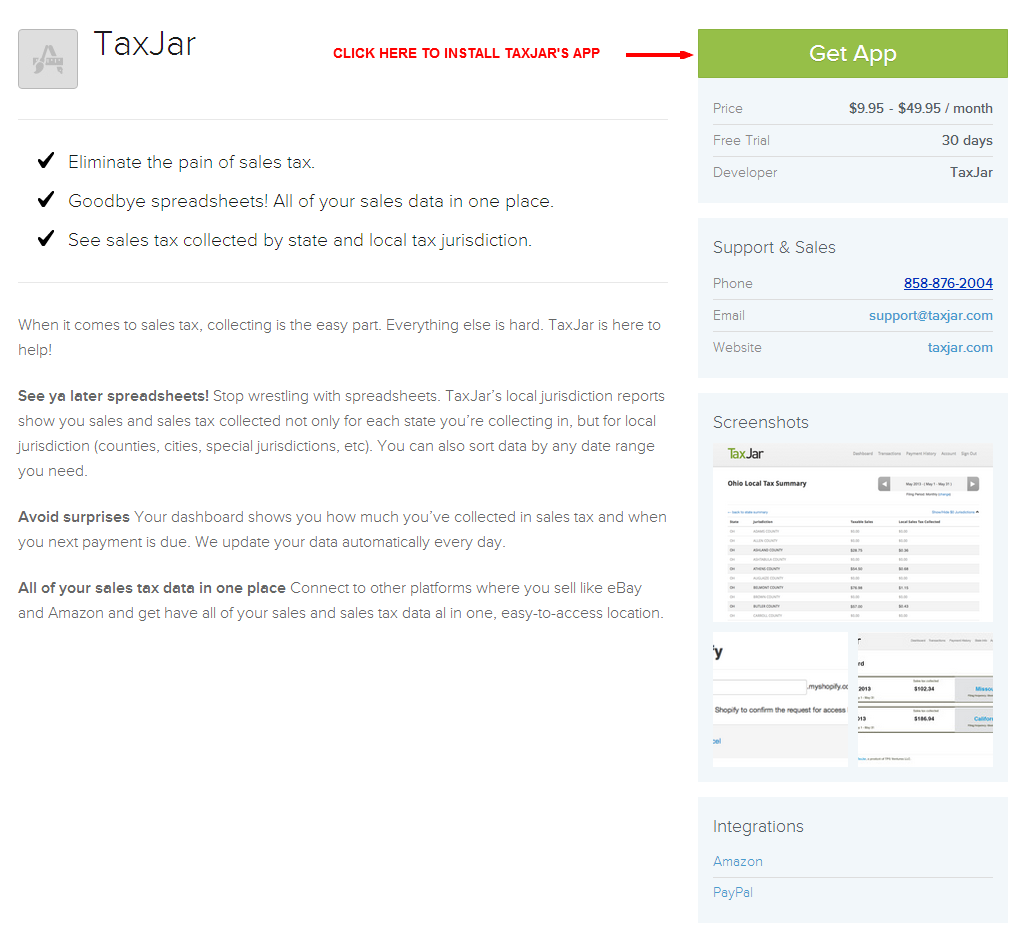

How to Install the Shopify Sales Tax Plugin from the Shopify App Store

Collecting is the easy part, pulling reports to accurately fill our your returns is another story. Shopify doesn’t provide these reports, which is where TaxJar comes in.

Ready to get started? You can either install shopify from within TaxJar or from the Shopify App Store.

-

Go the Shopify app store and click the “Get App” button.

-

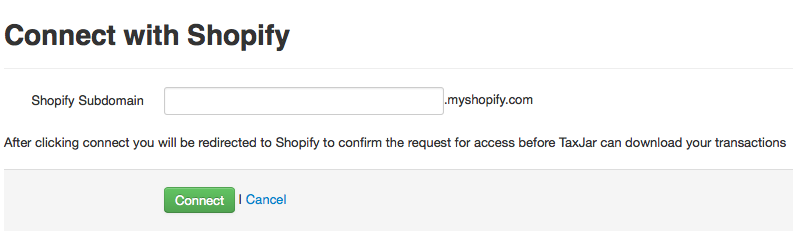

Then all you need to do is just type in the name of your store’s subdomain and you’re done! We’ll send you an email when your sales data has been downloaded.

-

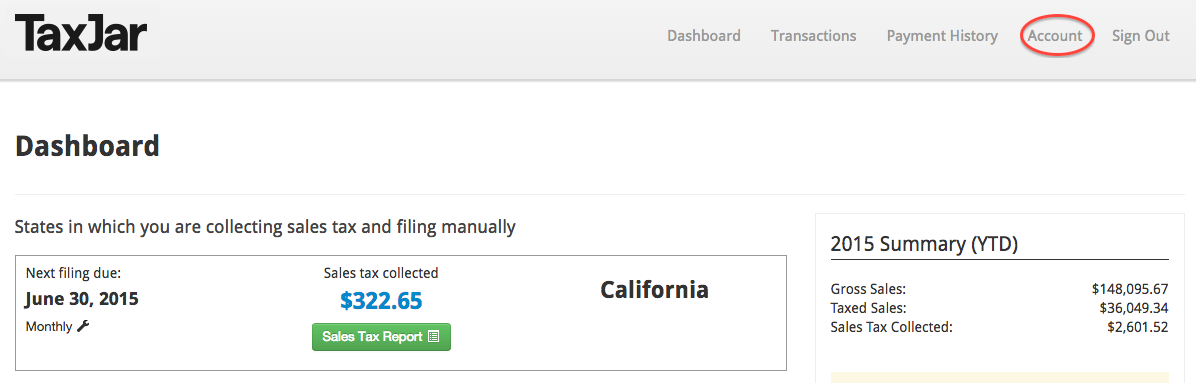

Now you are set up with TaxJar and ready to view your the reporting of your sales tax collected, AutoFile and more available in your TaxJar account. Login to TaxJar Today.

How to Install the Shopify Sales Tax Plugin from TaxJar

If you prefer to install the shopify plugin from your TaxJar account, follow the instructions below.

-

Login to TaxJar (just trying it out? No worries. There’s a free, no-risk 30-day trial.)

-

Click “Account” in the top navigation menu

-

Click “Linked Accounts” on the left-hand menu bar

-

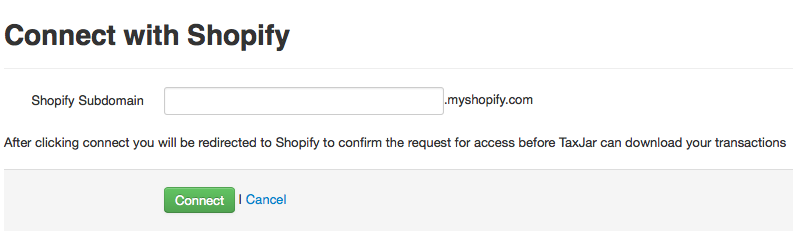

Click “Connect to Shopify”

-

This will take you to our shopify setup page. Then all you need to do is just type in the name of your Shopify store’s subdomain and proceed to link your account! We’ll send you an email when your sales data has been downloaded..

-

Now you are set up with TaxJar and ready to view your the reporting of your sales tax collected, AutoFile and more available in your TaxJar account. Login to TaxJar Today.

If you have additional questions or need help integrating your Shopify and TaxJar accounts, please contact our support team.