- Platform

- PayPal

- Last Updated

- December 14, 2016

This guide will take you step by step through how to integrate TaxJar into your PayPal account. You’ll learn how to configure PayPal to automate sales tax calculations as well as what you need to do when it comes time to file.

Sales tax is complex, with regulations changing constantly. For a primer on the basics of sales tax, including nexus, registration, filing, reporting, calculations and more, please visit Sales Tax Fundamentals. Also, be sure to take a look at our Resource Center, with articles, webinars and videos for beginners and experts alike.

How to Connect Your PayPal Store

To connect TaxJar and PayPal, your first step is to set up sales tax collection in your PayPal store.

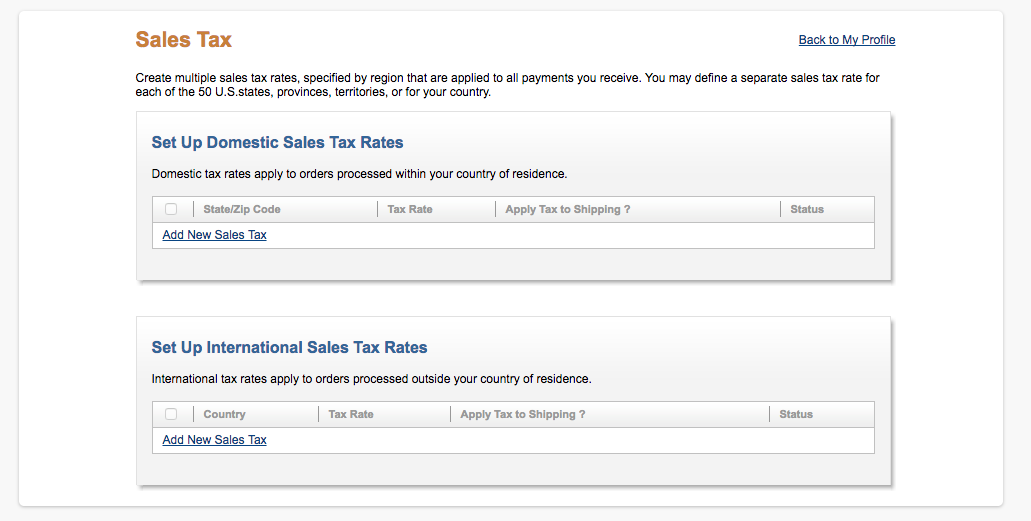

- Login to your PayPal account and click here to visit your PayPal Sales Tax page

- Under “Set Up Domestic Sales Tax Rates” click “Add New Sales Tax.”

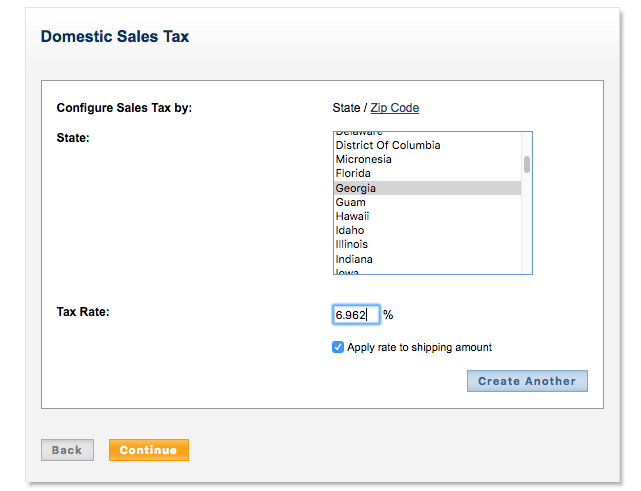

- From here, you can choose whether to set up sales tax by state or by zip code.

- Choose either state or zip code (more on that below), and select a sales tax rate. (Refer to our PayPal Average Sales Tax Rates chart page for rates).

- Choose whether or not you want to charge sale tax on shipping charges. You can also find this information on our PayPal Average Sales Tax Rates chart.

Should you set up PayPal sales tax by state or by zip code?

The majority of states are “destination-based sales tax states” which require merchants to charge the sale tax rate at their buyer’s ship to address. When this is the case, charging a single sales tax rate in each state doesn’t cover all of the scenarios. In this case, you have two options:

-

Visit our PayPal Average Sales Tax Rates chart page and enter the average rate for that state - If you do this, you’ll need to use a tool like TaxJar’s “Expected Sales Tax Due” report to ensure you are remitting the right amount of sales tax to the state. Keep in mind that, we provide an average rate, so once in awhile one of your customers may be charged more sales tax than they are accustomed to. If that happens, you can refund the excess, but this this is not an ideal situation.

-

Add separate sales tax rates for every zip code - With this method, you can enter a separate sales tax rate for each zip code in your state. This will require finding the sales tax rate at each zip code. While this method will be more accurate, most states ** have hundreds of zip codes, so this can be time consuming. Also, states vary in when and how they publish their sales tax rates (many don’t publish them by zip code) so this can also be frustrating to attempt.

-

Charge the state rate - A third option is to charge your state’s sales tax rate but pay the county, city and special taxing district rates out of pocket. We don’t recommend this, because it means that sales tax eats directly into your business’s profits.

Tax Exempt Products

Keep in mind that some products (such as food and clothing) are taxed differently in some states. Find your state (or states) in our sales tax by state guide to determine if you are selling any tax exempt or differently taxed items.

Connecting TaxJar to Your PayPal Account

- If you haven’t already, sign up for a TaxJar account. (There’s a 30-day no risk free trial. No credit card required to test TaxJar out!)

- Connect TaxJar to your PayPal account - From your TaxJar dashboard, click Account > Linked Accounts > Connect to PayPal. From here you’ll be asked to login to your PayPal account. Do that, and we’ll take you to a page asking you to grant permission for TaxJar to access your account. Click “Grant Permission.” From here, TaxJar will begin importing your transactions from PayPal (PayPal.) This generally takes a couple of hours, but may take longer if you have very high sales volume.

- If you sell on multiple channels, connect your other accounts with TaxJar. This allows us to pull in all of your online transactions and create return-ready sales tax reports.

Using TaxJar with your PayPal Account

Once you have TaxJar set up with your PayPal Account (and all of the other accounts you sell on) the real magic begins.

When it comes time for you to file your sales tax return, TaxJax has created a return-ready sales tax report so you can quickly and easily file. Just click the state in which you are filing on your TaxJar Dashboard.

If you have additional questions or need help integrating PayPal and TaxJar, please contact our support team.