Handling Sales Tax with Laravel Cashier

Building a SaaS application with Laravel and wondering how to collect sales tax? You’ve come to the right place! In this guide we’ll cover how to use TaxJar’s sales tax API with Laravel Cashier, an interface to Stripe’s subscription billing services. After including TaxJar’s API client in your Laravel project, you’ll be able to calculate sales tax on the fly when creating a new subscription or single charge.

If you’re not familiar with SaaS taxability in the United States, review this blog post first to determine if you actually need to collect sales tax in the states where you have nexus. At this time, only a handful of states consider SaaS products taxable. We update our posts frequently to reflect new changes, so make sure to keep an eye on it. Remember, always ask your accountant for advice if you have unique sales tax requirements you’re unsure about.

Getting Started

First you’ll want to install the taxjar/taxjar-php package via Composer using the following command:

composer require taxjar/taxjar-php

TaxJar API Token

You’ll also need a way to authenticate with our sales tax API to request rates. Sign up for a TaxJar account to generate a new API token. From there, copy and paste the API token into your project’s .env file:

TAXJAR_API_TOKEN=[Your API Token]

Now you can securely reference that token anywhere in your app using env('TAXJAR_API_TOKEN'). Nice!

Setting Up Laravel Cashier

If you haven’t already set up the Cashier package in your Laravel project, you’ll want to do that now. Follow this guide to get started and run the necessary database migrations.

Once you’ve perused Laravel’s documentation for managing subscriptions and written some code for your controllers, we’ll be able to extend your billable model (such as User) to provide a tax rate for subscriptions.

Adding Sales Tax to Subscriptions

Jump into your billable model and add a new public class method called taxPercentage:

```php <?php use Laravel\Cashier\Billable;

class User extends Authenticatable { use Billable;

public function taxPercentage() {

return 0;

} } ```

This method will be invoked when creating a new subscription in Stripe. As of Dec. 2014, Stripe now includes the tax_percent attribute in their subscription object. Laravel Cashier simply populates the tax_percent attribute based on the returned value from the taxPercentage method.

Let’s introduce some logic into this method to first determine if we need to collect sales tax for a given user. For these examples, let’s pretend you have nexus in two states: New York (NY) and Washington (WA). SaaS products are taxable in both of these states. You also have a User model with the Billable trait in your model definition. The User model has a set of address_ attributes so we can reference the user’s address for calculating tax: address_street, address_city, address_state, address_zip, and address_country.

If the user resides in New York or Washington, we’ll make an API request for the tax rate. Otherwise we’ll return 0. This dramatically reduces the amount of API calls you’re making to TaxJar and can save you money.

```php <?php use Laravel\Cashier\Billable;

class User extends Authenticatable { use Billable;

public function taxPercentage() {

if (in_array($this->address_state, ['NY', 'WA'])) {

// Request rates if user resides in NY or WA

}

return 0;

} } ```

Next, let’s import \TaxJar\Client into the User model namespace and instantiate the client with your API token:

```php <?php use Laravel\Cashier\Billable;

class User extends Authenticatable { use Billable;

public function taxPercentage() {

$client = \TaxJar\Client::withApiKey(env('TAXJAR_API_TOKEN'));

if (in_array($this->address_state, ['NY', 'WA'])) {

// Request rates if user resides in NY or WA

}

return 0;

} } ```

Finally, we’ll make a request to the /rates/:zip endpoint using ratesForLocation with the following parameters: street, city, and country. These parameters are optional, but important for accurate rates. For example, if a street address is provided, we’ll return back rooftop accurate rates in states where we have the necessary boundary data, such as Washington.

The zip argument is always required. At a minimum, make sure you have the user’s zip code on file. If you only provide a zip, read this blog post regarding sales tax accuracy around zip-based rates.

```php <?php use Laravel\Cashier\Billable;

class User extends Authenticatable { use Billable;

public function taxPercentage() {

$client = \TaxJar\Client::withApiKey(env('TAXJAR_API_TOKEN'));

if (in_array($this->address_state, ['NY', 'WA'])) {

try {

$rates = $client->ratesForLocation($this->address_zip, [

'street' => $this->address_street,

'city' => $this->address_city,

'country' => $this->address_country

]);

return round($rates->combined_rate * 100, 2);

} catch (Exception $e) {

// Log error

}

}

return 0;

} } ```

Notice we’re using the combined_rate attribute to return the tax percentage in Laravel Cashier, rounded to two decimal places as required. This works great for NY and WA because they’re both destination-based states and we’re collecting sales tax based on the user’s address. If you have an origin-based nexus state, you’ll want to collect sales tax based on your business address instead.

Another thing you’ll want to consider is how to handle API errors beyond logging. We provide a summarized rates endpoint with average and minimum rates for each state/region. This means you can store the average rate for NY and WA somewhere in your database just in case you’re unable to retrieve a rate from our API, reducing the likelihood of under-collecting sales tax.

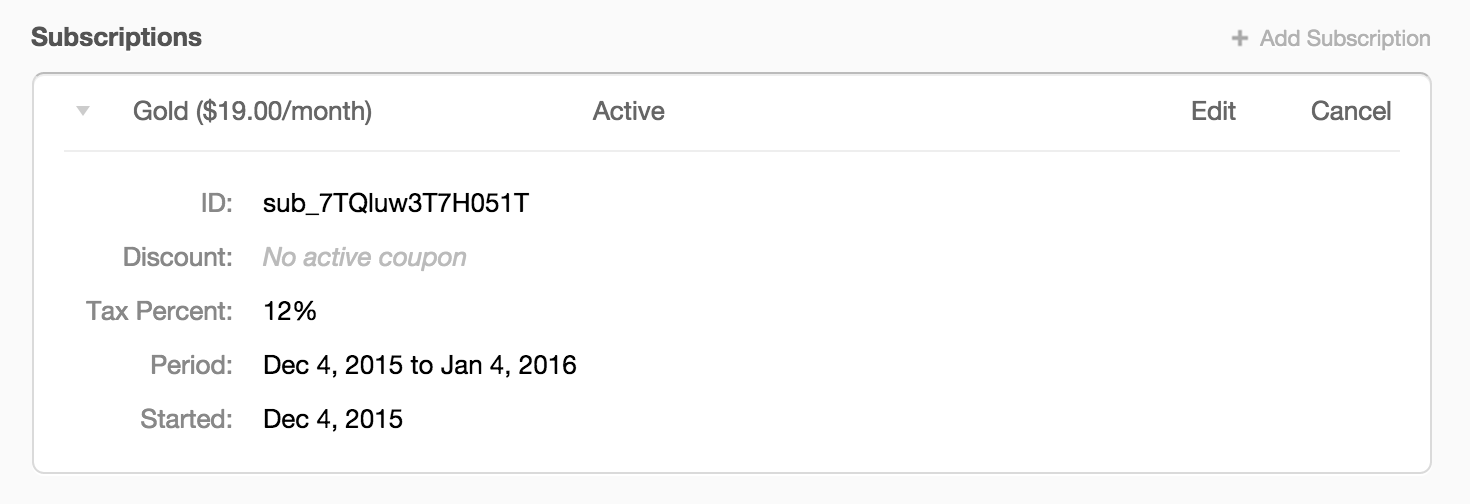

After creating a new subscription, you’ll be able to see the tax percentage under Subscriptions as “Tax Percent” in the Stripe dashboard:

Adding Sales Tax to Single Charges

Making a single, one-off charge in Laravel Cashier is simple:

php

<?php

// Stripe Accepts Charges In Cents...

$user->charge(100);

Unfortunately, there’s no tax parameters to be found in Stripe’s charge object. This means you’ll want to add the sales tax amount (in cents) to the final amount. You can either use our ratesForLocation method to get the rate and calculate yourself, or use taxForOrder to retrieve the amount_to_collect attribute. Our /taxes endpoint automatically handles sourcing logic and product exemptions:

```php <?php $client = \TaxJar\Client::withApiKey(env(‘TAXJAR_API_TOKEN’));

try { $tax = $client->taxForOrder([ ‘from_country’ => ‘US’, ‘from_zip’ => ‘92093’, ‘from_state’ => ‘CA’, ‘from_city’ => ‘La Jolla’, ‘from_street’ => ‘9500 Gilman Drive’, ‘to_country’ => ‘US’, ‘to_zip’ => ‘90002’, ‘to_state’ => ‘CA’, ‘to_city’ => ‘Los Angeles’, ‘to_street’ => ‘1335 E 103rd St’, ‘amount’ => 100, ‘shipping’ => 0, ‘nexus_addresses’ => [ [ ‘id’ => ‘Main Location’, ‘country’ => ‘US’, ‘zip’ => ‘92093’, ‘state’ => ‘CA’, ‘city’ => ‘La Jolla’, ‘street’ => ‘9500 Gilman Drive’, ] ], ‘line_items’ => [ [ ‘id’ => ‘1’, ‘quantity’ => 1, ‘product_tax_code’ => ‘30070’, ‘unit_price’ => 100, ‘discount’ => 0 ] ] ]);

// Charge the user $100.00 (subtotal) + $8.00 (tax)

$subtotal = 10000;

$taxAmount = $tax->amount_to_collect * 100;

$taxPercent = $tax->rate * 100;

$total = $subtotal + $taxAmount;

$user->charge($total);

} catch (Exception $e) { // Log error } ```

Fortunately, we can use the metadata parameter to list out the tax amount and rate to reference later if needed:

```php <?php // … // Charge the user $100.00 (subtotal) + $8.00 (tax) $subtotal = 10000; $taxAmount = $tax->amount_to_collect * 100; $taxPercent = $tax->rate * 100; $total = $subtotal + $taxAmount;

$user->charge($total, [

'metadata' => [

'tax' => $taxAmount, // $8.00 tax amount

'tax_percent' => $taxPercent // 8% tax rate

]

]); // ... ```

The metadata attribute is a simple way to store a set of key/value pairs in a structured format. It’s available in most Stripe objects. When reviewing payments in the Stripe dashboard you’ll be able to see this metadata under Payment Details or in the JSON objects for logging and events.

If you’re based in Canada or the EU, you could store the full tax breakdown in the metadata attribute as well:

php

<?php

// Charge the user €100.00 (subtotal) + €25.00 (VAT)

$user->charge(12500, [

'metadata' => [

'tax' => 2500, // VAT amount

'standard_rate' => 25,

'reduced_rate' => 6,

'super_reduced_rate' => 12,

'freight_taxable' => true

]

]);

Wrapping Up

That covers how to handle sales tax calculations with Laravel Cashier and TaxJar for both subscriptions and single charges. If you have any questions about our sales tax API, feel free to contact us. We’re always happy to help out!